Greg Isenberg is a multi-exit Silicon Valley entrepreneur and owner of Late Checkout product studio. He has:

- Headed Product Strategy at WeWork

- Been an advisor to Reddit

- Founded a startup, Islands, which was sold to WeWork

- Founded 5by, which was sold to StumbleUpon

Guest Author: Greg Isenberg

I bought 50% of a business 1.5 years ago, and it’ll do $2-3M of free cash-flow this year.

I got paid back my original investment in 6 months.

It got me thinking…

This is the golden era to buy a venture-backed business.

Startups are going OUT OF BUSINESS left, right and center.

They want to raise more VC, but they can’t. Raised too much in the ZIRP era and tons of VCs still on sidelines.

They want to sell, but they can’t. Anti-trust and high interest rates are making big acquirers more cautious.

They want to go IPO, but they can’t. There are 85% less IPOs in 2023 than 2021. The bar to IPO is sky high.

So what’s going to happen?

The amount of startups going out of business is skyrocketing.

They either shut down.

Or they sell for pennies on the dollar.

Maybe that’s where you come in.

You see, a lot of these businesses are great businesses.

Some of these products are

But they’ve just raised too much capital.

Many founders are just going to want to move on.

There’s a whole new generation of founders who are going to buy businesses and turn them into holding companies

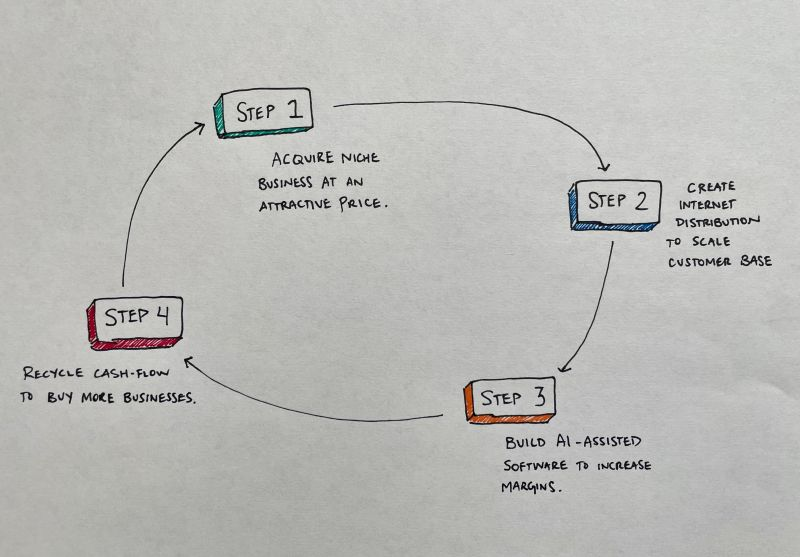

This is how they’ll do it:

Step 1: Acquire businesses at an attractive price

Step 2: Create internet distribution to scale customer base

Step 3: Build AI-assisted software to increase margins

Step 4: Recycle cash-flow to buy more businesses

I did this 1.5 years ago.

1) Bought 50% of http://boringmarketing.com, best SEO implementors on the planet

2) Scaled Boring Marketer audience and community to 40,000+

3) Built a suite of AI tools that makes http://boringmarketing.com unbeatable at SEO and helps get our margins to 50%

4) Using cash-flow to buy a new businesses (more on those soon)

We were able to partner with the best team on the planet because to create a high-margin, asset light business.

Even VCs I know want to talk to me about cash-flow businesses.

Some are even getting involved on the size of their day-jobs.

All of sudden cash flow is cool.

Those “boring” internet businesses powered by audiences, community, SEO (cc @boringmarketer

) are top of mind.

And unlike VC-backed business (most fail, few win massively), there are tons of “middle class” cash-flowing internet businesses. Especially tons of AI wrapper ones.

I see http://boringmarketing.com doing AI-assisted SEO for LOT of these profitable Internet businesses. They are EVERYWHERE.

More and more folks will either snap these businesses up or start them.

So, as the VC market starts to crack.

It’s the golden era for buying. A way more surefire path towards wealth creation.

I figured I’d share how I’m thinking about it in case it’s valuable to someone.

If it’s valuable, share and let me know.

Buying cash-flow companies is the NEW building venture-backed companies.