Darryl is the founder and CEO of LFG, which is like the "Spotify for travel" and is an Antler program grad.

Previously he held positions in Grab and was Chief of Staff at Quqo.

Guest Author: Darryl Han

You’re traveling through Southeast Asia, enjoying the vibrant street food scene.

You’ve just had the most amazing bowl of noodles, or something, at a local street vendor. You go to pay with your card — debit, credit, ApplePay, whatever. Because that’s what you’re used to.

But the shop owner apologizes: “Sorry, no card.”

So, you reach for cash but realize you’re short of change. You think, “Oh, sh…”

Sound familiar?

The way we travel has changed dramatically, and so has the way we pay. Digital payments are now essential for our daily lives and travel experiences, offering convenience, speed, and security.

Southeast Asia (SEA) is a vibrant, diverse region known for its rich cultures, bustling markets, and exotic landscapes.

For tourists, it’s a treasure trove of unique experiences. For small and medium-sized businesses (SMBs), the influx of tourists presents immense opportunities.

Yet, to fully harness these opportunities, there is still a need for SMBs to embrace wider digital payment acceptance.

Rise of Digital Payments in Southeast Asia

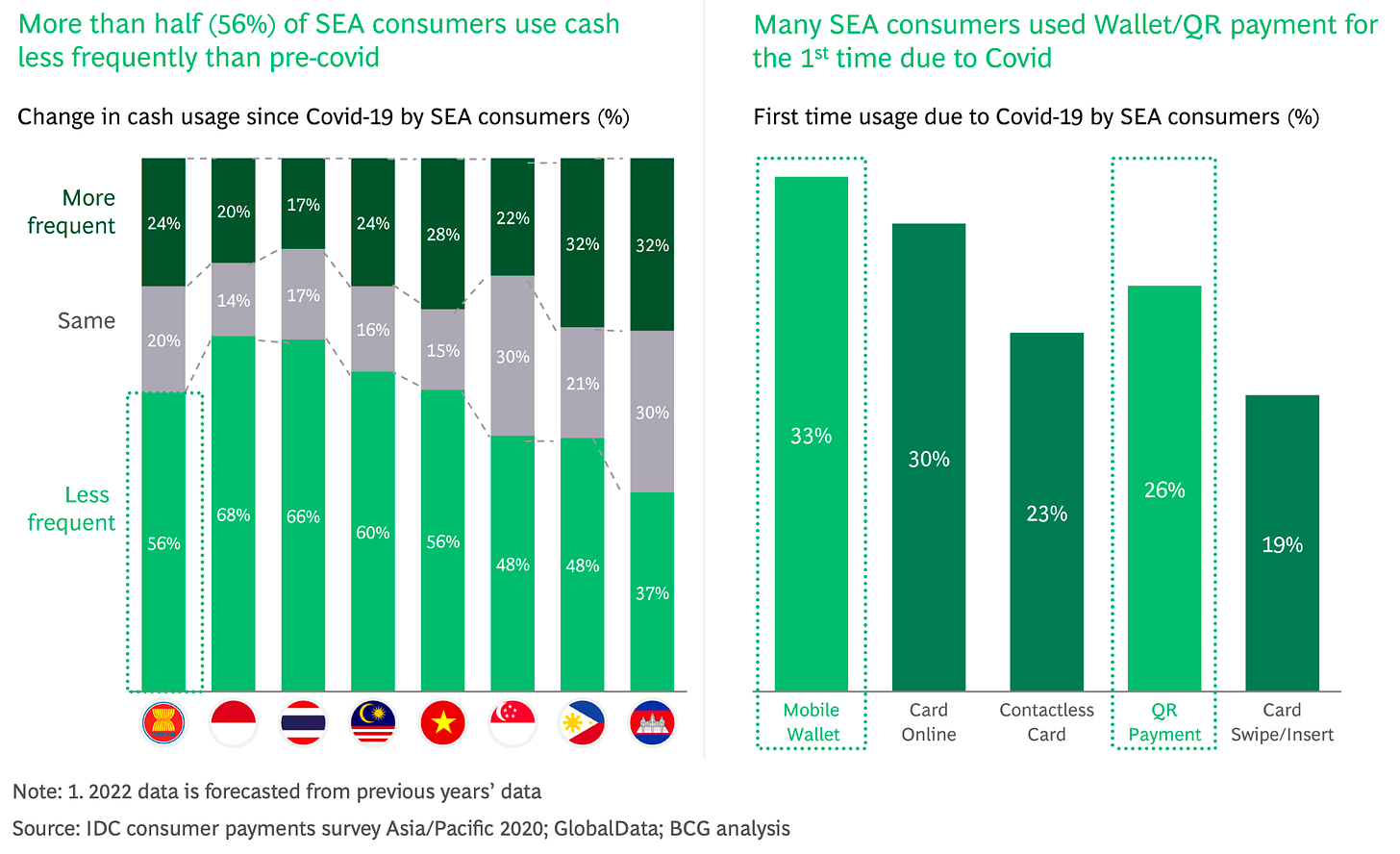

In recent years, SEA has seen a significant rise in digital payment adoption, driven by fintech advancements, increased smartphone penetration, and of course, Covid-19.

E-wallet usage among locals has become widespread. Digital payments using e-wallets in SEA are predicted to grow from US$22 billion in 2019 to over US$114 billion by 2025.

QR code payments are rapidly gaining traction in SEA, with countries having launched their own national QR code standards, such as VietQR in Vietnam and PromptPay QR in Thailand.

The volume of QR code payments in SEA is expected to surge by 590% by 2028, increasing from 13 billion in 2023 to 90 billion.

Payment Challenges for Tourists in Southeast Asia

Despite these advancements, many SMBs in the region still rely heavily on cash transactions. This creates barrier for tourists and digital nomads (like myself) who prefer digital payment methods for convenience and security.

And besides this ‘cash is king’ precedence, each country in SEA has its own digital payment systems and standards, making it difficult for tourists to use their preferred payment methods across borders.

How does this fragmentation impact the overall travel experience? Well, the lack of interoperability between national payment networks basically hinders seamless transactions for us travelers in the region.

Tourists and nomads are forced to carry cash or struggle with currency exchanges because they can’t use their digital wallets or credit cards, and bare the risk of theft or loss.

“I only cary cards. I never carry cash even back in Japan. If they don’t accept card, then I simply don’t eat there.” — Naoto, Product Manager at a Japanese fintech startup working in Ho Chi Minh City, Vietnam

The frustrating point is that credit card payments may incur high currency exchange fees, and finding ATMs and currency exchange services can be a hassle, with potential security and scam concerns.

Without a local bank account, tourists and nomads are unable to use local eWallets or pay with local QR codes either, limiting their access to digital payments.

Is the region truly ready for tourism to fully adopt digital payments yet? I can’t help but wonder why haven’t companies like Grab, whoever regional coverage in SEA, done more to bridge these gaps and create a more unified payment system.

Challenges of Digital Payment Adoption for SMBs

For SMBs, the benefits of adopting digital payments are substantial. By offering digital payment options, SMBs can attract more tourists who prefer these methods, potentially boosting sales.

Digital payments also enable faster settlement of funds, improving SMBs’ cash flow and reducing the need for manual reconciliation.

However, several challenges hinder wider adoption of digital payments among SMBs in SEA.

For one, the lack of reliable internet connectivity and necessary infrastructure can be significant showstoppers. Concerns about security and fraud can make both businesses, as well as customers hesitant to adopt digital payments.

Additionally, SMB owners, often from older generations, may lack awareness or knowledge about digital payment solutions and how to implement them effectively.

Transaction fees and the cost of setting up digital payment systems and POS devices can also be a deterrent for small businesses with tight margins and budget.

The Digital and Interoperable Way Forward

Governments will play a crucial role in addressing these challenges by investing in digital infrastructure, offering subsidies or incentives for SMBs to adopt digital payment systems, and running awareness campaigns. Take Vietnam’s Cashless Day for example.

Collaborations with fintech firms and startups can also provide SMBs with affordable, secure, and easy-to-implement digital payment solutions.

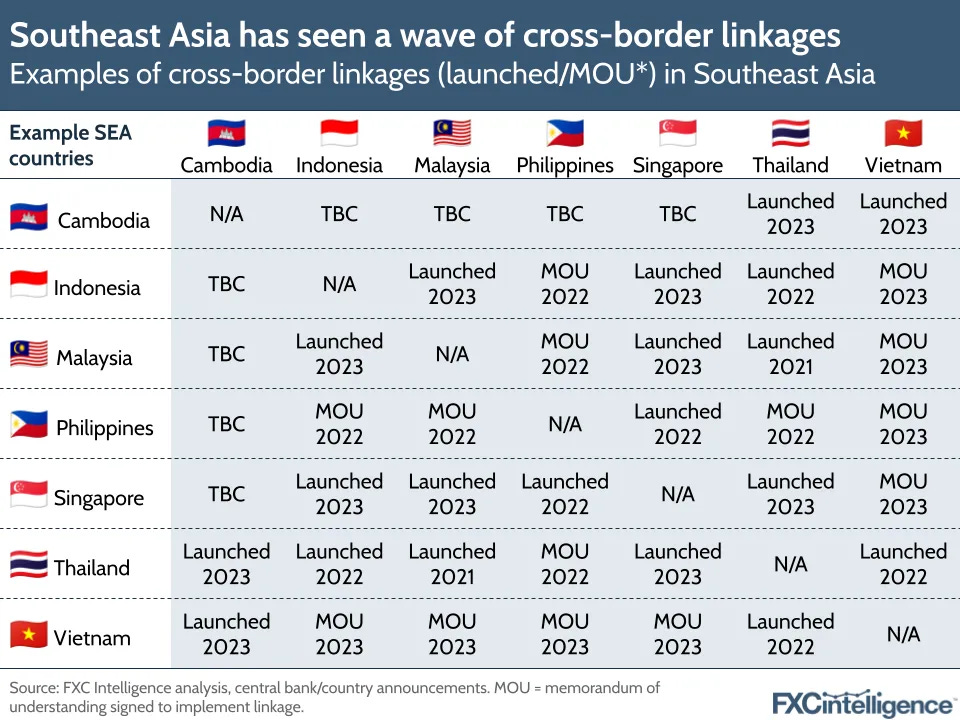

SEA countries are already actively linking their real-time payment (RTP) networks to speed up cross-border transactions, with nations like Thailand, Singapore, Malaysia, and Indonesia already established connections.

Currently, many cross-border payment systems operate bilaterally; for example, Singapore’s PayNow is connected with Thailand’s PromptPay and Malaysia’s DuitPay, facilitating faster and more cost-effective transactions.

The next step involves creating multilateral payment networks through Project Nexus, an initiative by the Bank for International Settlements (BIS) to standardize and simplify cross-border transactions across the region.

“Even with just the first wave of connected countries, Nexus has the potential to connect a market of 1.7 billion people globally, allowing them to make instant payments to each other easily and cheaply.” — Agustín Carstens, General Manager of the BIS

As the SEA region continues to grow as a major tourist destination, SMBs that adapt to the changing preferences of their tourists and nomads will be better positioned to reap the benefits.

With the right support and strategies, SMBs in Southeast Asia can harness the power of digital transformation, unlocking new levels of growth, prosperity, and a cashless future – where seamless card and local QR payments become the norm for tourists, nomads, and locals alike.