Daryl is currently an Investor at Trihill Capital, investing in early-stage startups across South-East Asia & Founder of The Next Batch.

He was previously at Hypotenuse AI (YC S20) and Deskimo (YC S21), wearing multiple hats across Growth, Product, Partnerships, Marketing and Analytics.

Guest Author: Daryl Lim

What’s happening in South-East Asia’s #startup & #tech ecosystem?

Last week, there were several insightful reports published:

January Capital – 2023 State of the ASEAN Technology Ecosystem Report

Glints & Monk’s Hill Ventures – Southeast Asia Talent Trends Report 2024

Ninja Van – Behind the rizz of Social Commerce

🔍 Here are the key insights:

1/ State of the ASEAN Tech Ecosystem

– In 23, SEA observed 📉 in total capital invested from $8.4B in 22 to $5.5B; No. of funding events remained resilient, as total deals 📈 from 760 to 855 in 23.

– SG is the most active ecosystem in Southeast Asia. While 🇮🇩 experienced a decline in deal count, there was an increase YOY for 🇹🇭 , 🇵🇭 & 🇻🇳 based deals

– While most sectors observed an increase in deal count YOY in 23, #SaaS, #Healthcare & E-Commerce saw the most 📈

– #Fintech (31%) & #ecommerce(10%) continue to account for majority of funding in with Healthcare, F&B & AI seeing positive growth over the last 2 years

– Pre-money valuations 📉 across most sectors at Seed & Series A – with E-Commerce & Fintech seeing the most material decline YOY.

Access the report here: https://shorturl.at/auJT9

2/ Southeast Asia Talent Trends Report

– Product has the highest demand among SEA startups at 24%, followed by Engineering at 18% & Marketing & PR at 17%

– Among technical roles, VP of Engineering commands the highest salary, with an annual median salary of $193,200

– For non-tech roles, VP of Marketing commands an annual salary of $162,000, followed by VP of Sales at $148,800.

– 41% of startups have🔻 their budget for hiring, with 22% maintaining the same budget & 26% 🔺 their budget

– Startup salaries cool in 23 with junior engineering roles seeing the sharpest 📉 of -6%.

– The top initiatives for retaining talent are: Flexible work schedules (22%), Career advancement paths (20%) & ESOP (20%)

– Due to #AI, content teams are most likely to experience headcount reduction (31%) followed by Customer Service (14%) & Marketing & Sales (11%)

Access the report here: https://shorturl.at/hmvIW

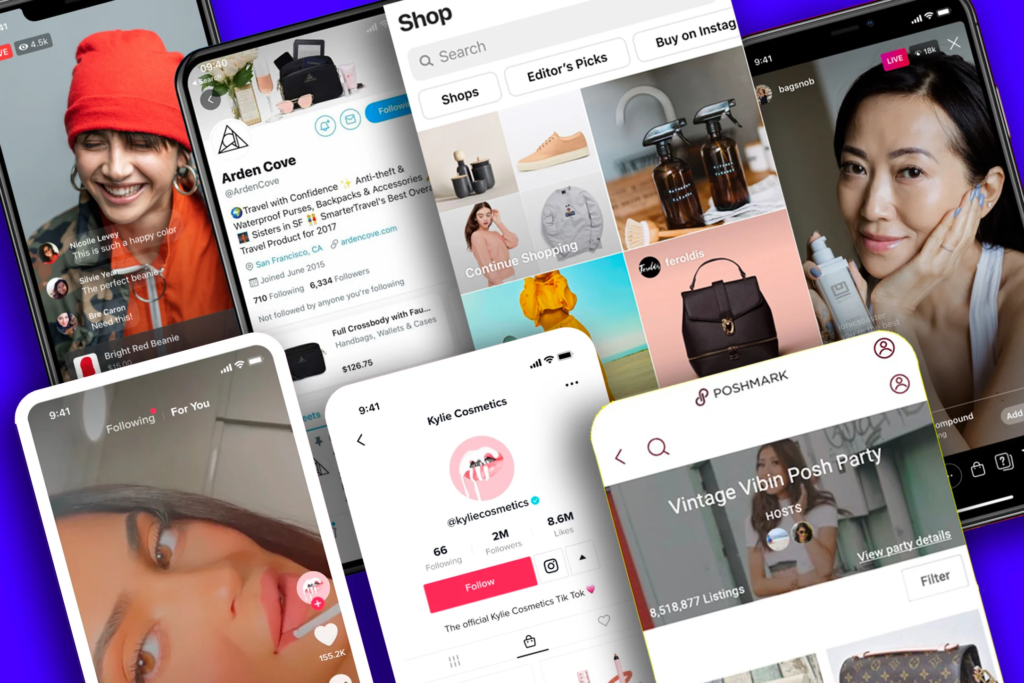

3/ Behind the rizz of Social Commerce

– The ideal Social Commerce experience consists of discovery, consideration & purchase. In SEA, only TikTok shop delivers this ideal.

– Social Commerce helps sellers reach more potential shoppers as relying on a single platform can be risky.

– These platforms reveal the content that shoppers engage with, the influencers they follow & when they’re most active.

– Social #commerce fosters word-of-mouth – liking, commenting & reposting.

– Social commerce allows for testing product popularity fast. This saves costs by avoiding a mass launch of an unpopular product & earn more after identifying PMF for new product.

– To see results on social-first, commerce-second platforms, the social element must precede the commerce element.

Access the report here: https://shorturl.at/quEIP