Jeff leads the Partnerships Team at Forecastr — a leading FP&A software company that helps startups create great financial models to impress investors, confidently raise capital, and effectively run their businesses better.

He also serves on the advisory boards of several startup companies and is an active angel investor.

Guest Author: Jeff Erickson

Have you already built a careful, thoughtful financial plan for the year?

With venture capital much tighter, it’s even more important to have a solid financial plan and manage your runway.

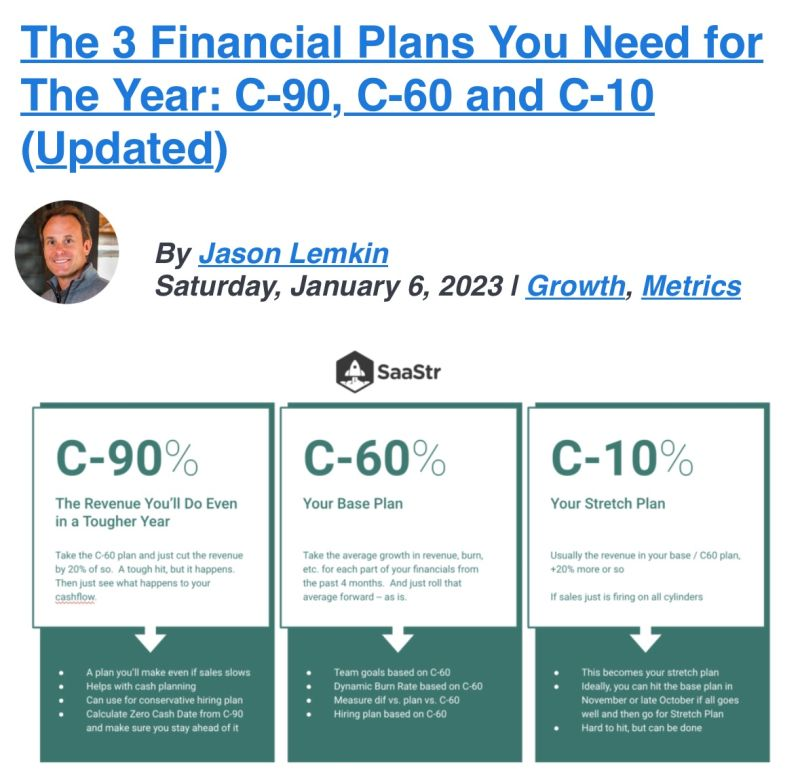

Jason M. Lemkin, Founder of SaaStr, details out the 3 plans you need to make for your business as a founder:

C-60 Plan

This is one you have a 60% confidence rate you can hit (C=Confidence).

Much higher, and you aren’t pushing hard enough. Much lower, and it’s too risky to plan around. This is your base plan.

C-10 Plan

This is a variant of the C-60 plan that you think maybe, just maybe, you can hit. Usually, it’s around 20% higher than the base / C-60 plan in SaaS. So if your base plan is to grow 100% next year, your C-10 plan is often 120% growth. This becomes your stretch plan. Much higher than 10%, and it’s too easy to achieve. Any lower, it becomes implausible. But you can tweak this to C-15 or C-20 if you want.

C-90 Plan

This one is just for planning purposes. The broader team doesn’t use it. This plan is if the burn stays the same, but revenue comes up short. You need this plan to know how long your cash lasts if next year is harder than planned. It’s fairly easy to build as well. Take your C-60 plan, keep the expenses the same, but cut the revenue, say, 20%. Watch your burn and your Zero Cash Date go way up. Make sure you have enough cash to support this model. Especially these days.

Check out the full article from Jason here: https://lnkd.in/gDZxbb5Y

hashtag#foundershashtag#financialmodelinghashtag#startups