Viktoriya Tigipko is one of the most recognized names in the Eastern European VC community and is a native of Ukraine.

She runs TA Ventures, a pre-seed and seed stage VC, since 2010. Additionally she founded iClub (an angel network), WTech (a community for women in tech), and is Chair of the Board at the Ukrainian Startup Fund.

Guest Author: Viktoriya Tigipko

Latin America has always been a region of contrast-rich in natural resources yet burdened by economic inequality.

For investors, it has long been seen as a high-risk, high-reward environment.

However, in recent years, I really think something remarkable has been unfolding. Despite all of the bureaucratic hurdles, scarce capital, and corruption… Latin America is creating world class tech companies.

And for VC’s like me, the region is increasingly proving to be a place where investments can yield outsized returns.

LATAM’s Resilience in Adversity

Not long ago I was browsing thru this research report by Atlantico on the digital transformation of the region and I was really impressed.

So I wanted to highlight in today’s article some of the things that I found interesting.

Operating in Latin America is not for the faint-hearted. The conditions are tough—capital is costly, human talent is limited, and red tape is abundant.

Yet, it’s precisely these adversities that have created an environment where only the most resilient entrepreneurs thrive. The ability to navigate these complex waters gives rise to companies that aren’t just successful but exceptional.

A prime example of this resilience is the “Triumphant Three”—Mercado Libre, Nubank, and iFood.

These companies have not only succeeded but have grown to dominate their respective sectors on a global scale.

- Mercado Libre is Latin America’s largest company, commanding a market cap of over $100 billion, thanks to its unique ecosystem of commerce, fintech, logistics, and advertising.

- Nubank, the world’s largest digital bank, has revolutionized banking for over 100 million customers.

- iFood has become one of the most successful food delivery platforms globally, both in terms of profitability and market penetration.

The success of these three is not just a testament to the grit of their founders but also to the immense potential that exists in Latin America’s digital economy.

Market Dynamics Over Market Size

One might assume that Latin America’s relatively small market size compared to giants like the U.S. or China would be a disadvantage. However, the opposite is often true.

The constrained capital and human resources in the region limit the amount of competition.

This creates an environment where winners not only take all but take more than they would in more crowded markets.

For example, the ‘Triumphant Three’ (Mercado Libre, Nubank, and iFood) capture greater market shares and higher returns on investment than their global peers.

The Digital Transformation

The region is home to some of the world’s most digitally engaged populations, with social media platforms, online marketplaces, and apps like WhatsApp becoming integral to daily life.

WhatsApp, for instance, has become the default platform for business communication, while e-commerce is seeing rapid growth, driven in part by the success of platforms like Mercado Libre.

But the region’s transformation isn’t limited to the digital realm. Latin America is well-positioned to lead the global clean energy transition.

Trillions in Value Yet to Be Captured

Despite the rapid advancements in digitalization, the most compelling aspect of Latin America’s tech landscape is the sheer amount of value yet to be captured.

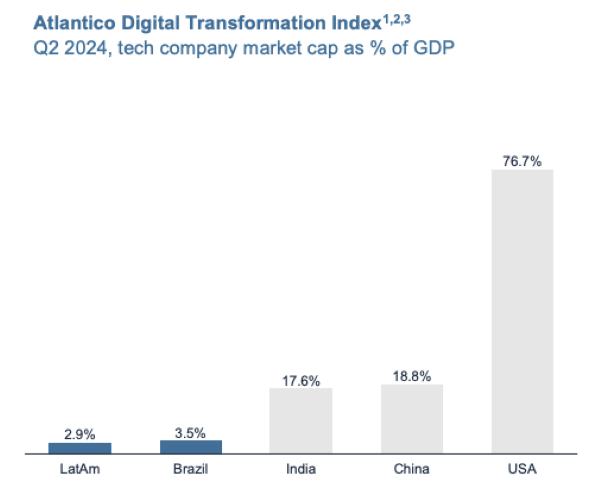

Latin America’s tech market currently represents only 3.5% of the region’s GDP, far behind countries like India, China, and the U.S. This gap presents a monumental opportunity for investors.

The report estimates that trillions of dollars in value could be unlocked as the region continues to develop its tech infrastructure. Latin America has the potential to catch up to global peers in the tech sector, particularly in e-commerce, fintech, and artificial intelligence.

Fintech and Regulatory Innovation: The Pix Revolution

Latin America has been a trailblazer in fintech innovation, with countries like Brazil leading the way.

The introduction of Pix, Brazil’s instant payment system, has transformed how people and businesses transact. Pix’s ubiquity, combined with Open Finance regulations, has spurred a wave of fintech innovation that is now attracting global investors.

The regulatory environment in Latin America, often seen as a hindrance, has paradoxically become a driving force behind the region’s fintech success.

AI is the Next Frontier

Artificial intelligence is another area where Latin America is poised to make significant strides.

The region’s developers are already outpacing their global peers in adopting AI tools. According to the report, 74% of Latin American developers use AI weekly, compared to 60% in the U.S.

Many Latin American startups are already incorporating AI into their core business models, from customer support to logistics and creative content.

Our Entrance Into LATAM

The report concludes how Latin America’s digital renaissance is well underway, and the region is primed for outsized returns.

The convergence of digital adoption, fintech innovation, AI advancements, and a burgeoning green energy sector makes it one of the most exciting places for venture capital today.

The region may still have hurdles to overcome, but we completely agree with the report that its future has never looked brighter. And we plan to be a part of it.

The areas that interest us are fintech, AI, healthcare, complex enterprise solutions, and sticky consumer products.

In terms of geography our main focus will be on the larger markets like Brazil, Mexico, Argentina and Columbia.

I’d like to also highlight that we have some terrific partners in the region.

We are partnered with Olga Maslikhova and The J Curve, the leading English-speaking content platform about entrepreneurship in and from Latin America. . You can check out more about them here: https://www.linkedin.com/company/thejcurve/

And we are also partnered with Nazca VC in Mexico.

Do you want to work with us?

There are a variety of ways of working with us. The easiest way is if you are considering angel investing then have a look at iclub.vc.

This is our angel network that consists of 1,000+ angels in 40+ countries and growing. iClub is backed by TA Ventures and is a great place to start for first time angel investors.

There is a simple form to fill out on the site and after being qualified you will have access to our exclusive deal flow.

If you’re interested in TA Ventures than you can see our team here and you can reach out to the person that you feel is most appropriate to your inquiry: https://taventures.vc/team/.