A2D Ventures is Southeast Asia’s prominent early-stage venture capital firm, syndicate, and investing platform. The firm invests in innovative and impactful companies across various sectors, with a focus on supporting entrepreneurs who are building the future of Southeast Asia.

Guest Author: Ankit Upadhyay

When I read this story a little while back I found it both surprising and inspiring. Nvidia today is a ~$3 trillion market cap company.

It is neck and neck with a few other big name tech companies as you can see here.

But given i’m an investor and naturally see things from that lens, I also want to focus on some of the lessons from their initial investment round.

That initial round came in the form of a $2 million check from Sequoia Capital in 1993. But let’s first back it up a bit and tell you a bit about how things all started.

Nvidia started with a wild idea in 1993

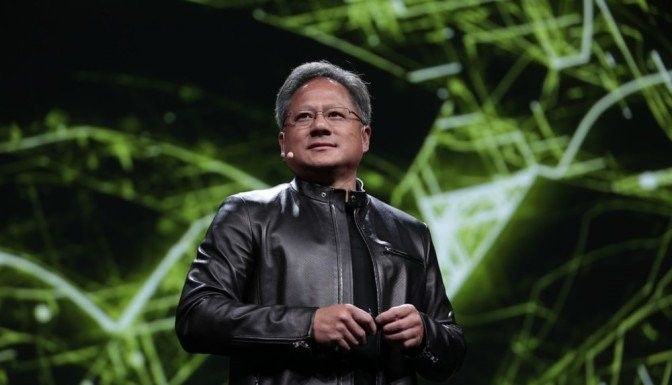

It all started with three friends who all had a background in computer engineering: Jensen Huang, Chris Malachowsky and Chris Priem.

They were frustrated with the limitations of existing computer graphics. Back then, gaming and graphical applications were rudimentary at best. If you wanted to play a game, you’d be dealing with blocky, pixelated images that looked like something a five-year-old might have drawn with a box of crayons.

The guys knew there had to be a better way. Their vision was clear—they wanted to create a chip that could render high-quality graphics in real time, a technology that would push the boundaries of what computers could do. But there was a problem: no one had ever done it before. The hardware they needed simply didn’t exist.

Despite the odds, they believed in their vision. They believed so much that they were willing to bet their careers on it. So, in 1993, in a small office space that they could barely afford, Nvidia was born.

Their first product: the NV1

Nvidia’s first chip, the NV1, was launched in 1995. It was revolutionary—or at least it was supposed to be.

The NV1 was an ambitious attempt to integrate both 2D and 3D graphics processing, a feat that had never been done before. It even had built-in sound processing, making it a multi-faceted marvel of engineering.

The problem was that most of the gaming industry standardized around a different technology, which left Nvidia’s product struggling to find a foothold.

Despite being technically impressive, the NV1 wasn’t the success the founders had hoped for.

Time to raise money

So the story about their first fundraise goes something like this.

The company was struggling and was low on capital and Jensen, himself, only had about six months of living expenses in the bank at the time.

He decided they needed to raise money.

The problem was that he didn’t even know how to write a business plan. So he bought a book called “How to Write a Business Plan” to learn.

But he gave up after only flipping through a few pages, deciding he needed an easier approach.

So he went directly to the CEO of his former employer, LSI Logic Corporation, Wilfred Corrigan. Who promptly told him “This is one of the worst startup pitches I’ve ever heard.”

But anyway introduced him to Don Valentine, the founder of Sequoia Capital with the intro “I’m going to send you a young man, I hope you can invest in him, he was one of our best employees.”

In comes Don Valentine of Sequoia Capital

Don Valentine was already a legend in Silicon Valley. He had a track record of early investments in companies that would go on to become giants, such as Apple and Cisco.

Valentine was particularly known for his keen ability to identify promising entrepreneurs and innovative technologies. As well as his direct, no-nonsense approach.

Don heard his pitch and didn’t really like the idea. But he saw vision and determination in Jensen.

Plus he saw potential in the company’s focus on graphics processing—a technology that he believed would be crucial as personal computing continued to evolve.

He decided to invest. But warned “If you lose my money, I will kill you.”

In 1993, Sequoia Capital, under Don Valentine’s guidance, led Nvidia’s first major investment round, providing $2 million in funding.

This was a significant amount for a young startup, and it came at a critical time. It gave Nvidia the resources it needed to continue developing its technology, hire top talent, and refine its product strategy.

The first real breakthrough didn’t come till 1999

Nvidia finally ‘arrived’ with the release of the GeForce 256, the world’s first GPU in 1999.

Before the GeForce 256, graphics processing was handled by graphics cards, but these were not as specialized or powerful as what Nvidia introduced.

Nvidia coined the term “GPU” to describe the GeForce 256, which was a single-chip processor capable of handling complex graphics operations that were previously done by the CPU (Central Processing Unit).

This introduction of a dedicated GPU shifted the workload from the CPU to the GPU, allowing for more efficient and powerful graphics rendering, which laid the foundation for future advancements in gaming and professional graphics.

Now of course Nvidia is on top of both the AI and gaming worlds

Now Nvidia is the undisputed leader in the GPU market, particularly in the discrete graphics card segment.

As of 2024, Nvidia holds a significant majority of the market share, with its GeForce series being the go-to choice for both gamers and professionals.

Nvidia’s GPUs have become the backbone of the AI and deep learning revolution. They are widely used in data centers, research labs, and enterprises for tasks such as image recognition, natural language processing, and autonomous driving.

How did Don Valentine help make Nvidia what it is today?

Product Strategy

Valentine was instrumental in helping Nvidia refine its product strategy. He advised the company to learn from the initial struggles of the NV1 and to develop technology that could lead the market rather than lag behind.

Hiring and Team Building

Valentine understood the importance of building a strong leadership team. He advised Jensen Huang and his co-founders to hire top talent and create a team that could execute Nvidia’s ambitious vision. This included bringing in experienced engineers and executives who could help the company scale.

Leadership Development

Don Valentine also played a role in mentoring Jensen Huang as a leader. Huang, who had a background in engineering, was new to running a company. Valentine provided guidance on how to lead a growing organization, make strategic decisions, and navigate the challenges of a rapidly changing industry.

Navigating Tough Times

Nvidia faced several challenges in its early years, including the commercial failure of the NV1 and intense competition in the graphics market. Valentine’s experience and steady hand were crucial during these periods.

Encouraging Innovation

Valentine was a proponent of innovation and risk-taking. He encouraged Nvidia to push the boundaries of what was possible in graphics processing. This culture of innovation became a core part of Nvidia’s DNA, driving the company to become a leader not just in gaming graphics but also in AI, deep learning, and other cutting-edge technologies.

We at A2D Ventures aspire to help young founders the way Don Valentine did

In our view it is all about having the right values and attitude as an investor.

And we try to find investors that aspire to find and support the future Nvidia’s of the world.

Who are we? A2D Ventures is Southeast Asia’s prominent early-stage venture capital firm, syndicate, and investing platform.

The firm invests in innovative and impactful companies across various sectors, with a focus on supporting entrepreneurs who are building the future of Southeast Asia.

We at A2D; perform smart and thorough due diligence on all startups we invest in and have a competent team working on curated deals.

Using our digital-first platform and investment process – we communicate with transparency to our syndicate members and founders alike while ensuring our investors get quarterly business updates for the startups they invest in.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.