True to its name, “For Entrepreneurs By Entrepreneurs,” the venture capital firm FEBE Ventures is dedicated to supporting early-stage startups by launching a second investment fund targeting $75 million in capital commitments.

The Singapore-San Fransisco co-investment

The Singapore-based firm also forged an exclusive co-investment partnership with San Francisco’s Tekton Ventures as part of its more global investment mandate for Fund II.

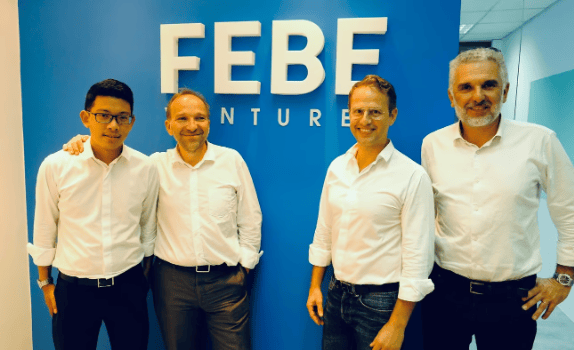

Managing partner Olivier Raussin founded FEBE Ventures and has backed over 35 Southeast Asian startups. New additions to the leadership team include ex-Partech GP Nicolas El Baze, angel investor Aditya Pendyala, and Tekton managing partner Jai Choi.

The second fund’s key backer is Otium Capital, the family office of a serial entrepreneur.

Pierre-Edouard Stérin, anchoring FEBE’s first fund

While initially focused on SEA, Fund II has a wider geographic and sector scope at the pre-seed and seed stages, with typical checks from $250K to $750K.

According to Raussin, FEBE II will remain active in Southeast Asia but make more global bets thanks to partnerships like that with Tekton Ventures.

Raussin said the collaboration enables the two funds to share deal flows and co-invest across the US, Europe, SEA, and emerging markets:

“We are very geographically complementary, so we decided to craft these exclusive and long-term partnerships.”

Founder’s Aim

As founders-turned-VCs, FEBE Ventures aims to provide the kind of startup support it wished for, with candid advice and emphasis on building sustainable, profitable businesses.

The $75 million second fund will continue that founder-friendly approach to backing global startups – only now with more capital and an expanded international network courtesy of partners like Tekton Ventures.Powered by beehiiv

Fund II 2.5x Bigger Than Predecessor, Partners with Tekton