Andrew Wilkinson is the co-founder of Tiny Capital, which owns companies including AeroPress, MetaLab and Dribble. Tiny Capital is often called the “Berkshire Hathaway of Tech Companies” and went public in 2023 with a billion dollar valuation.

Guest Author: Andrew Wilkinson

Founders often think a startup running out of money or not being able to raise another round from investors is the end.

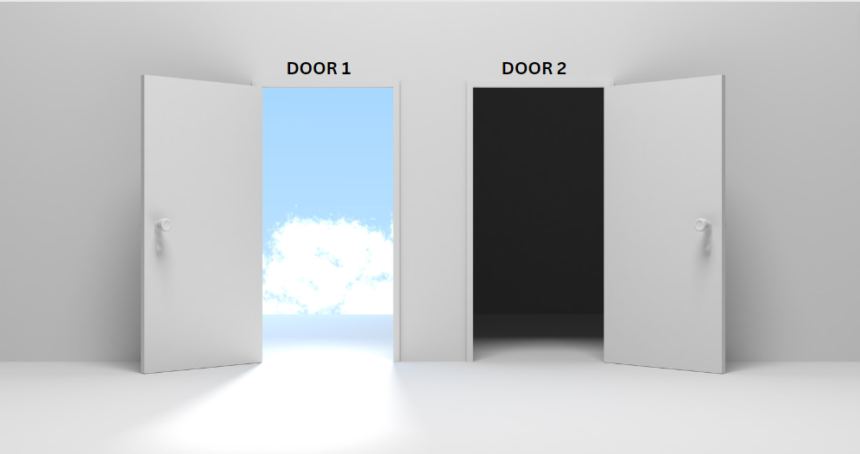

They think there’s only two doors.

DOOR 1: Shut down, let go of all your staff, and throw away years of work.

DOOR 2: Do a depressing acquihire to save face. You and your team get jobs at Facebook or something.

Sure, you can say you “sold” your last company (technically true), but in reality, you basically shut down and took a job, maybe with a signing bonus.

Usually your years of work still goes into the dumpster. But there’s a third door that very few people think about… Venture investors think in binary outcomes. Either you’re a billion dollar business or you’re a zero.

They have to. They make 20 crazy bets, and depend on 1 or 2 being massive home runs. Their incentive is to push you to grow as fast as possible, and if it doesn’t work, it doesn’t work.

Once they realize you aren’t the next Facebook, most just want to leave the board and move on. To a VC, a small outcome might as well be no outcome. There’s nothing inherently wrong with this, it’s just the model required to take risk in venture. But often, you’ve built something great. You have a product with passionate users.

You have a great team. You have some revenue.

Sure, the P&L is a bit bloated. You spend too much on Facebook ads. Your office could use a downgrade. But there’s actually a good business underneath and it’s worth saving. The third door is simple: partner with someone like us to buy out your investors.

What’s that you say? “But I can never get rich doing that! I’m better off starting my next startup.”

WRONG. Over the past 10 years, we’ve purchased many “failed” venture startups that were left for dead by venture capitalists.

Often for next to nothing. The VCs don’t value them—they just want out. I’d estimate we’ve made over $30M in profits over the past decade from businesses we’ve bought for next to nothing.

And we don’t gut them. Many of them are still going strong today, with happy teams and happy customers. We simply bought out the VCs, right sized the expenses, and ran it logically for the longterm, with an eye to profit. I know many of you are going through this right now, and I’d ask you to consider the third door.

If you’d like a partner, we’re all ears. Email austin@tiny.com and we can give you an answer/commitment in 24-hours if needed.

Come to the light side. Cashflow and profits are a much easier way to get rich than trying to build the next billion dollar startup (95% failure rate).

Check out the original tweet here.