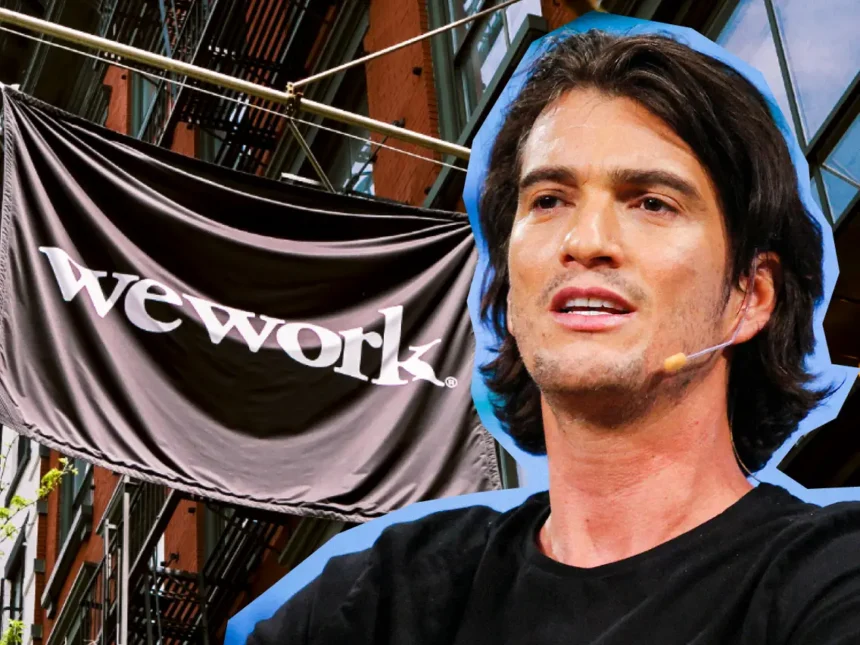

- Ousted WeWork co-founder Adam Neumann attempts buyback of struggling company via new venture Flow.

- Backed by investors, surprising comeback bid follows WeWork’s fall from a $47B valuation.

- However, WeWork remains noncommittal to Neumann’s return amid past controversies.

Former WeWork CEO Adam Neumann is looking to purchase the struggling flexible workspace firm out of bankruptcy through his latest venture Flow Global Holdings.

Neumann’s lawyers claimed they were rebuffed when previously trying to arrange up to $1 billion to stabilize WeWork as it veered towards collapse in late 2022.

From highs to lows and back?

WeWork notoriously fell from a $47 billion valuation to bankruptcy last November after years of overexpansion and questionable practices under Neumann’s leadership.

Now with backing from investors like Dan Loeb’s Third Point hedge fund, Neumann surprisingly wants WeWork back despite his controversial ousting in 2019.

WeWork’s cautious stance

In response to the buyback attempt, WeWork stated it regularly fields interest from parties and reviews approaches focused on the company’s independent future sustainability. Meanwhile, Third Point said talks with Neumann so far remain only preliminary.

Should the offer progress, venture firm Andreessen Horowitz would gain a WeWork stake since it previously bet $350 million on Neumann’s current startup Flow – the firm’s largest individual check ever. But WeWork remains noncommittal to its former leader’s comeback bid.