UnaFinancial is a group of companies developing easy-to-use digital financial solutions across Asia and Europe. The group aims to provide simple and reliable access to finance through innovative technologies, focusing on what customers truly need. Since its foundation, UnaFinancial has served more than 17 M clients, granting access to loans worth over USD 2 billion.

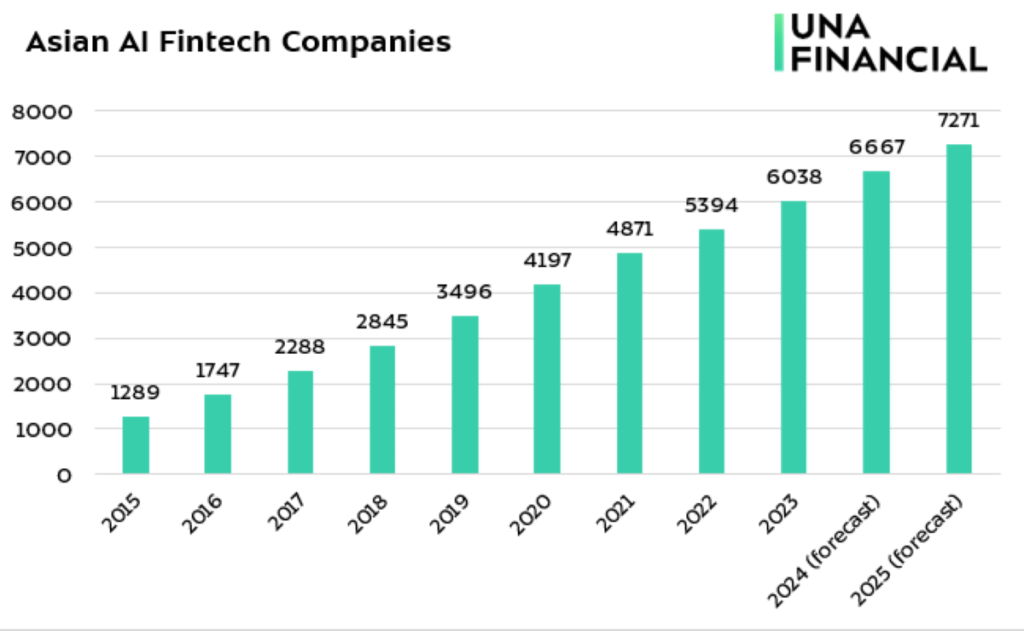

Meanwhile, the number of AI fintech companies in the region is expected to exceed 7,200, representing 7% of the local fintech industry. The countries driving the AI fintech growth in Asia include India, China, Singapore, and Israel. These are the findings of UnaFinancial’s study.

Singapore | October 22, 2024 — Fintech companies employing AI have been growing year by year, consistently increasing their share within the Asian fintech ecosystem. According to UnaFinancial’s analysts, the number of such companies in the region is expected to reach 7,271, in 2025, making up 7% of the local fintech industry. To compare, this number equaled 1289 in 2015 (3.6% of all fintech companies), and 6038 in 2023 (6.3%).

The analysts comment: “Compared to the COVID-19 pandemic peak, there has been some slowdown in the growth of new AI fintech companies in Asia. However, the market continues to expand, both with the introduction of new companies and the active adoption of AI by already existing players.”

In terms of funding, after hitting a “low” in 2023, Asian AI fintech companies are entering a stage of new interest from fintech investors. The share of funding received by these companies is projected to grow from $60.4 billion in 2023 to $62.0 billion in 2024 and $65.5 billion in 2025. Thus, the investment volumes in the sector are expected to increase 2.2 times next year. If the global socio-economic situation stabilizes, this could mark a new wave of investor attention to the industry.

Among the Asian countries, India, China, Singapore, and Israel are emerging as the powerhouses of AI fintech in the region. India dominates the list of active Asian AI fintech companies (41.7%), followed by China (12.2%), Singapore (9.8%), and Israel (9.6%).

UnaFinancial’s analysts explain: “India’s leadership is unsurprising given the country’s size, rapid fintech growth, and deep AI integration into financial practices, supported by the government. In China, the growth is driven by the large economy, while Singapore boasts the proactivity of local fintech businesses, which position the country as a regional fintech hub and trendsetter in Southeast Asia. Meanwhile, Israel stands out for its high standard of living, which supports the balanced growth of the entire fintech ecosystem and a favorable environment for startups.”