- Hong Kong startup inRiskable uses AI to scan the news for risks about bank customers.

- It flags suspicious events and assesses source credibility within minutes.

- The tool may soon help more banks conduct efficient due diligence.

Local startup inRiskable has developed an AI tool to help banks conduct due diligence by scanning online news sources for credibility risks and red flags about potential customers.

A massive help to banks

Co-founders Megan Chau and Kenyon Wong observed that many banks still rely on manual Google searches and printed articles to research companies, especially SMEs not covered consistently by major outlets.

Their solution employs natural language processing to extract insights from over 730 whitelisted publications in English and Mandarin.

Other exciting features

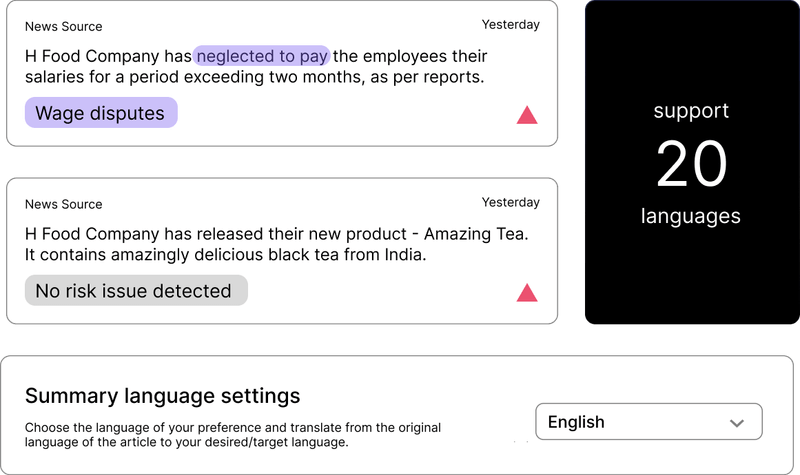

The AI flags suspicious events across 23 risk categories, including fraud, financial distress, litigation, and money laundering. It also assesses source authority and rates the severity of each finding. Banks receive automated risk reports within minutes to enable real-time decisions.

Secured two bank clients

By leveraging publicly available information at a fraction of the cost of services like Bloomberg Terminal and Factiva, inRiskable has already secured two banking clients and acceptance into a Hong Kong accelerator providing funding and connections.

The founders envision applications in crypto trading and beyond as they prepare to open an API and SaaS platform to the public this month. More banks may soon depend on AI to separate fact from fiction about their customers.