- Superbank launches Celengan, an auto-savings feature with daily deposits as low as $0.07.

- Users earn 10% annual interest, with savings automatically released at $333.

- Celengan is Superbank’s first major consumer product since its February 2023 rebrand.

Piggy bank reboot

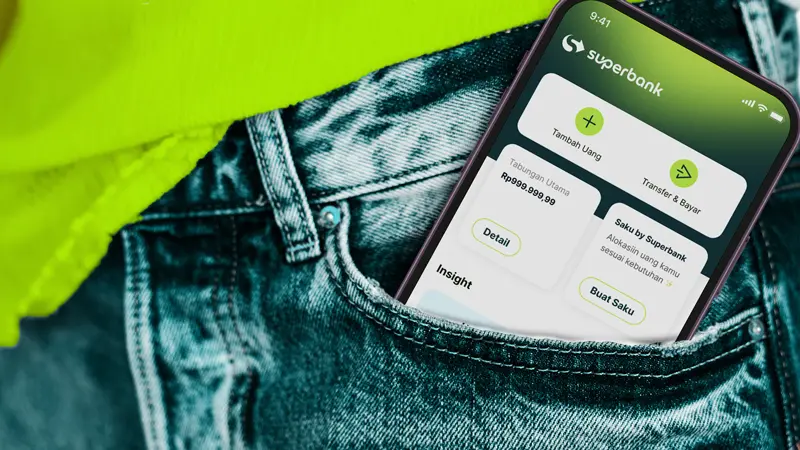

Superbank, the Indonesian digital bank backed by Grab and Singtel, has introduced a new auto-savings feature called Celengan (Bahasa for “piggy bank”). Accessible through its app, the product lets users automatically save a set amount daily.

Users can start saving with as little as US$0.07 a day through Celengan. The virtual piggy bank will automatically “break” once it reaches US$333. Continuing the high-interest trend among digibanks, Superbank is offering a tempting 10% per annum rate.

Grabbing digital banking share

Since rebranding from Bank Fama in February 2023, Superbank has launched financing products like working capital loans for female entrepreneurs and a US$40 million fund for startups. Celengan, however, appears to be its first major consumer-focused offering.

Grab’s GXS Bank in Singapore has rolled out personal savings, loans, and a debit card. Meanwhile, the GrabPay Card will be discontinued from June 2024, likely benefiting GXS.

In Malaysia, Grab’s GXBank became the country’s first digital bank in November 2023, offering targeted savings goals with up to 3% annual interest.

To read the original article: https://www.techinasia.com/grab-backed-superbank-introduces-auto-savings-product-in-indonesia